The first order of business for the Democrats, now with a 4-1 control of the board of supervisors, was to revisit the 2018 general fund operating budget passed last month by the Republican-controlled panel.

At the Jan. 10 meeting, the board voted along party lines, with lone Republican Kyle Davis dissenting, to reimpose a one-mill property tax hike to help fund improved services and reduce the projected deficit.

Voting for the new $12,567,459 preliminary operating budget were Democrats Phil Calabro and Jennifer Dix, as well as newly-elected John Mack and Linda Bobrin.

The one-mill tax hike had been examined during the previous budget process, but was scrapped in a 3-2 vote by the then-Republican controlled board.

But with party-control now reversed, the new board quickly scrapped that decision in hopes of both paring down a projected $1,350,000 deficit by the end of this fiscal year, as well as expanding needed purchases.

Back in the revised operating budget is the one-mill property tax which will cost the average homeowner a total of about $180 a year, an increase of roughly $40 on a property assessed at the $400,000 township average.

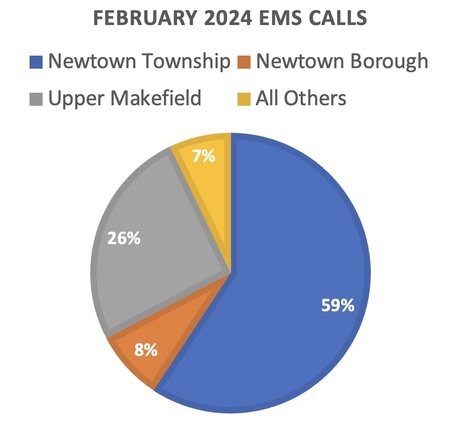

Of that one-mill hike, .45 mill would raise roughly $154,000 to fund the non-profit Newtown Ambulance Squad (NAS).

The remaining .55 mill would generate approximately $189,000 to be used strictly for fire hydrant maintenance in the township.

[NOTE: This special tax was changed in 2021: For rescue squad purposes the sum of 0.50 Mills on each dollar of

assessed valuation. In addition to that: For fire hydrant purposes the sum of 0.615 Mills on each dollar of assessed valuation.]

While the township generates most of its tax revenue from the one-percent Earned Income Tax (EIT), it also currently imposes 3.5 mills on landholders, which now would rise to 4.5 mills under the Democrats’ latest action.

[Also read “Newtown's "Volatile" Sources of Revenue”; http://bit.ly/volatileTax] ;

The proposed tax increase would now free up money in the general fund to fund other purchases, including buying four new police vehicles instead of the three that were earmarked in the previous 2018 operating budget approved in December.

The newly-approved preliminary budget also include a capital purchase of $155,000 for a new six-wheel dump truck to replace the current 20-year old vehicle, which township manager Kurt Ferguson had said was “starting to rot.”

Two new snow plows and a piece of equipment known as a skid-steer loader for inlet repairs are also back on the table.

New microphones and cameras for township public meetings would also be purchased.

In addition, the two underground gasoline tanks at the township complex would be removed, as now required under state Department of Environmental Protection (DEP) guidelines.

Further Reading:

• “The 2018 Budget Roller Coaster”; http://preview.mailerlite.com/c7o8l5 ;

• “Newtown Ambulance Squad Seeks Additional Funding”; http://preview.mailerlite.com/x4m0p2

Your new post is loading...

Your new post is loading...