The Council Rock School Board on Thursday, June 23, 2022, approved a $258 million budget for the 2022-23 school year that includes a real estate tax increase well below the Act One Index of 3.4 percent.

After voting down a proposed 1.59 percent tax increase, the board compromised on a 1.25 percent increase requiring the district to dip into its fund balance to the tune of $590,000.

The board voted 8-1 to approve the spending plan with Kristin Marcell voting against the motion. Marcell had favored a lower one percent increase, which had been debated by the board before settling on the compromise.

"In this time of inflation and available surpluses, I don't believe now is time to pass a tax increase at this number. I support something that is lower," said Marcell.

While Marcell favored a one percent increase, board member Yota Palli supported the 1.6 percent increase included in the administration's proposed final budget.

"The 1.6 percent increase is not going to allow us to go to town," she added. "It doesn't include our wish list and it's not preparing us for future investments such as full day kindergarten or changing the high school schedule. The 1.6 percent increase is respectful for people on fixed income because it is not a huge increase and is well below the state index."

[See “Insights” below for how much more money a typical Newtown Township homeowner would pay for a 1.25% tax increase in school taxes.]

The one percent earned income tax and the one percent real estate transfer tax remain unchanged in the new budget.

Your new post is loading...

Your new post is loading...

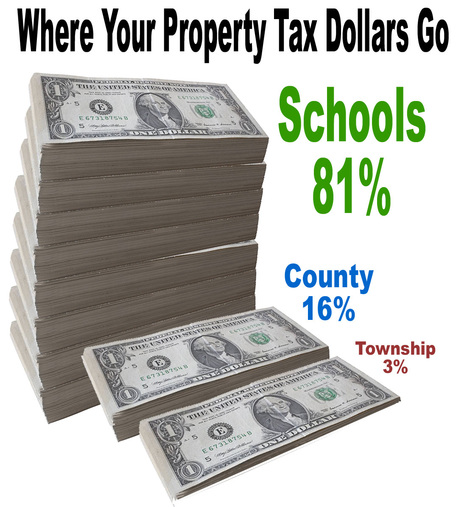

How much more would the average Newtown Township Homeowner pay in school taxes based on a 1.25% increase?

The current CRSD Millage is 132.80730. The average market value of a Newtown house in 2018 was $400,000 with an assessed value of $43,600. So, the CRSD tax currently for the average homeowner would be (132.80730 X $43,600)/1000 = $5,790.40.

A 1.25% increase in the millage rate = 1.66 Mills. That equates to (1.66 X 43,600)/1000 = $72.38 more dollars per year for a total of $5,862.78 for the average Newtown Township Homeowner based on the 2018 average assessment value of $43,600.

Meanwhile, a 1.25% increase in Newtown's real estate tax would amount to a $4.63 yearly increase for the average Newtown Township Homeowner based on the 2018 average assessment value of $43,600.