The Council Rock School District is raising property taxes to the state Act 1 maximum for the third straight year.

A 2018-19 final budget of $240.68 million approved by the school board at Thursday’s meeting hikes taxes 2.4 percent. The board could have applied to the state for exceptions to raise taxes more than that but chose not to.

The 2.4-percent increase equates to 2.897 mills, or $112 for a landowner with a property assessed at the school district average of $38,800. It increases total millage to 123.607, or an annual tax bill of $4,796 for the owner of the average assessed property.

Many district residents also pay a 1-percent earned income tax, which is split between the school district and its five municipalities of Northampton, Newtown Township, Newtown Borough, Upper Makefield and Wrightstown.

Property taxes were raised 2.5 percent for this school year which ends June 30, and 2.4 percent in 2016-17.

The district also is drawing $4 million from its $24 million savings account to balance the budget.

Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

| Tags |

|---|

|

Newtown News of Interest

These Scoops are excerpts from articles published in local newspapers and other sources that may be of interest to Newtown area residents. Please click on the "From" link to access the full original article. Any opinions and "insights" appended to these article summaries are solely those of John Mack and do not represent the opinions of any other person or entity. Curated by johnmacknewtown |

Your new post is loading...

Your new post is loading...

|

Scooped by johnmacknewtown |

Whoops! I Didn't Bring My Own Bag!

Recall that #NewtownPA's plastic bag ban recently went into effect. Unless a temporary exemption is granted, retail stores must stop supplying customers with non-recyclabe plastic bags and offer paper bags instead for which they can charge a fee of up to 10 cents per bag.

This past Monday I stopped by McCaffrey's in #NewtownPA and had a paper bag issue. As I explained on FB:

"I got this recyclable paper bag from McCaffery's yesterday for 10 cents. Wanting to save 10 cents, I put all my 3 small items in the bag - including a cardboard container in the bottom containing Swedish meatballs and gravy. Unfortunately, the gravy leaked through the cardboard box AND the bag. Next time I am going to have go to the produce department and put the hot food box in a plastic bag, which are still available!"

Now, I know you are going to tell me to have bags in my car and me of all people should know that.

- Paper bags that are labeled 100% recyclable, contain no old growth fiber, contain a minimum of 40% post-consumer recycled content and have visible labeling according to the Ordinance.

The McCaffrey's paper bags meet these requirements.

Will Retail Establishments be able to charge a fee for their bags?

- Retail Establishments may provide recyclable paper bags at the point of sale for a fee of not less than $0.10 per bag.

- All monies collected for the paper bag shall be retained by the Retail Establishment and the charge shall be identified on the receipt.

- The purpose of the fee for paper bags is twofold. First, it supports businesses by offsetting the added cost of paper bags. Second, it encourages consumers to bring their own bag, which is one of the goals of the Ordinance.

- The Retail Establishment may set their own charge for their reusable bags.

|

Scooped by johnmacknewtown |

This is my personal summary of the April 10, 2024, meeting of the #NewtownPA Township Board of Supervisors (BOS). This is not a complete nor an official summary.

Agenda Items, Discussions, Decisions, and More

- Reports of Committees, Boards and Commissions

- Board Member John Mack

- Public Hearing

- Reports of Officials

- Manager’s Report

- Other Items of Interest

|

Scooped by johnmacknewtown |

Chick-fil-A Fails CANCELS presentation before the #NewtownPA Planning Commission Meeting

Just 3 hours before the April 16, 2024, Planning Commission meeting, lawyers representing Newtown Equities LLC/Chick-fil-A, CANCELED their planned presentation before the Commission. I think they were not prepared to be confronted by the angry residents expected to show up.

When the meeting ended, I spoke to about 6 residents who were still in the parking lot wondering what the next step was. I suggested that they contact their representatives on the Board of Supervisors.

In case you wish to do the same, here’s the names and official email addresses of Supervisors: https://johnmacknewtown.info/contactnt.html

|

Scooped by johnmacknewtown |

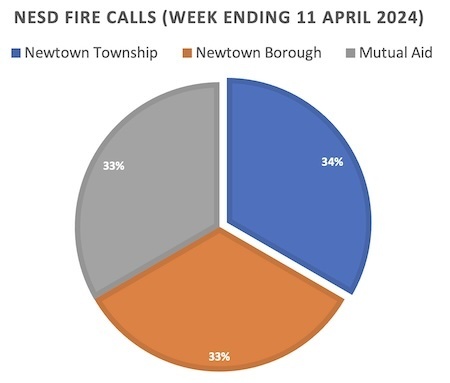

#NewtownPA Fire and Rescue (aka NESD) Weekly Calls: 4/5-11/2024

The following is a summary of the activities of the Newtown Fire Rescue for the week ending 11 April 2024.

Emergency Calls:

Fire Calls – 9 Township (3) Borough (3) Mutual Aid (3)

EMS Calls – 15 Township (15) Borough (0 ) Mutual Aid (0)

Weekly Highlights

- Fire Safety Inspections – 12

- U&O Inspections – 1

- Knox Box Inspections - 8

- Tank Inspections - 4

- Car Seat Installation- 1

- Fire Prevention Activity - 5

- Consultation – 5

|

Scooped by johnmacknewtown |

Have you seen this somewhat vague item on the agenda for the 16 April 2024 Newtown Township Planning Commission (PC) meeting?: “Newtown Equities, LLC., 98 Upper Silver Lake Road” (Variance Request #1213-24) under Zoning Hearing Board applications for review by the Commission.

Who is “Newtown Equities, LLC”?

When I saw that, I like many others shrugged, thinking it was just another citizen wanting to build a swimming pool. The "LLC," however, should have tipped me off to the fact that LLC's are usually created by developers to hide exactly who they represent.

So who is "Newtown Equities, LLC" and who do they represent?

It’s a New Jersey Domestic Limited-Liability Company created on June 22, 2021. That tells me nothing, but luckily the Variance Request Document that was distributed to all Commission members revealed that Newtown Equities, LLC is seeking variances for a proposed 6,110sq.ft. drive thru Chick-fil-A restaurant.

P.S. Chick-fil-A does NOT want to MOVE from its current location. I'm told, It wants to open a 2nd location.

Meanwhile, they have CANCELLED their appearance at the April 16, 2024, meeting of the Planning Commission! More about that here...

|

Scooped by johnmacknewtown |

Discover the Latest #NewtownPA information about Roadwork, Fate of the Washington Crossing Bridge, Planning for Future Housing Projects, and More…

Read the online version: https://www.johnmacknewtown.info/noiapr24.html

|

Scooped by johnmacknewtown |

Resistance to a potential project that could see the Washington Crossing Toll-Supported Bridge transformed into a bigger, broader span is growing.

In an effort to protect the 119-year-old span, the Upper Makefield Board of Supervisors is spearheading an effort to get the bridge placed on the National Register of Historic Places.

The board also recently passed a resolution that raises concerns that a major bridge overhaul — creating a much wider modern span — would wreak havoc on the historic character of Washington Crossing Village and the National Park of the same name, exacerbate flooding, send traffic problems soaring and have hazardous impacts on the environment, including threatening endangered species.

Now, Wrightstown is rallying to Upper Makefield’s cause.

At a public meeting on Monday, the Wrightstown Board of Supervisors authorized signing a companion resolution to Upper Makefield’s.

The Wrightstown resolution raises the same worries about traffic, the environment and the destruction of historical character. It also says that less costly and impactful alternatives to bridge replacement should be considered, including making the span a one-way bridge controlled by traffic signals.

Wrightstown Supervisor Chairman Chester Pogonowski noted that Wrightstown, Upper Makefield and Newtown Township collaborate through a local zoning jointure to control development and ensure quality of life for residents.

“The three neighboring municipalities have worked hard to preserve open space and historic resources,” Pogonowski said. “It is important to ensure that these are not compromised by another agency’s desire to increase the movement of traffic back and forth across the Delaware River.”

What About Newtown Township?

At its 10 April 2024 meeting, the Board of Supervisors was supposed to authorize the Township Solicitor to draft a Resolution opposing removal and replacement of the bridge, but that item was removed from the agenda at the last minute.

For background, listen to the discussion at the 25 March 2024 Meet Mack Monday Zoom meeting.

Related Content:

|

Scooped by johnmacknewtown |

The inaugural Bucks Culture Fest — an event intended to unite the community, while showcasing a myriad of cultures through live entertainment and interactive learning — will be held at Bucks County Community College Newtown Campus at 275 Swamp Road on Sunday, April 28 from 11 a.m. to 4 p.m.

REGISTER TO ATTEND HERE (IT'S FREE)

Arya Haridas is one of the featured performers at Bucks Culture Fest, presenting Bharatnatyam, a classical dance form that originated in southern India. Bharatnatyam requires years of training, which Haridas completed in 2022 with a 3-hour solo stage performance called Arangetram.

The idea came about last summer, when Angela Nutter, director of Doylestown Juneteenth, approached Jean Dolan, the college’s coordinator of DEI and community engagement, about collaborating on a free family-friendly event.

“I see the changing face of Bucks County and I really wanted to highlight some of those people in our community that maybe don’t feel represented. I also wanted to highlight those who have helped to build our community,” Nutter said.

It is with great excitement that we present the inaugural Bucks Culture Fest at the Newtown campus of Bucks County Community College on Sunday, April 28!

This is a grassroots effort started by ordinary community members to showcase, educate, and honor the many people who have built our rich Bucks County community.

The event will be FREE to all community members. We hope that you will be able to join us to be part of Bucks Culture Fest featuring local vendors, artisans, service groups and non-profit organizations. We are grateful to Bucks County Community College for hosting us this year. The school has been wonderful to work with in coordinating this event that can be uplifting to all.

|

Scooped by johnmacknewtown |

On April 4, 2024, the #NewtownPA Zoning Hearing Board granted Appeal 1210-24: i.e., Newtown Artesian Water Company (NAWC), requested variances from and a special exception pursuant to the Joint Municipal Zoning Ordinance of 2006, as amended, specifically Section 404(C) to permit a rear yard setback of 36.46 feet where a minimum of 50 feet is required; Section 404(C) to permit a building height of 40 feet where a maximum of 35 feet is permitted; to permit the construction of a PFAS filtration plant.

Supervisor Mack - a "party to the case" requested that a tree barrier be installed on the border with the Country Bend common ground to mitigate any noise generated by the facility.

For the first time, the Environmental Protection Agency has established national limits for six types of per- and polyfluoroalkyl substances in drinking water.

The EPA announced Wednesday that levels of PFOA and PFOS — two types of PFAS commonly used in nonstick or stain-resistant products such as food packaging and firefighting foam — can’t exceed 4 parts per trillion in public drinking water.

As of Wednesday, public water systems that don’t monitor for PFAS have three years to start. If they detect PFAS at levels above the EPA limits, they will have two more years to purchase and install new technologies to reduce PFAS in their drinking water.

Read “EPA imposes first national limits on 'forever chemicals' in drinking water”

|

Scooped by johnmacknewtown |

This is my personal summary of the March 27, 2024, meeting of the #NewtownPA Township Board of Supervisors (BOS). This is not a complete nor an official summary.

Access the 2024 BOS Chronicle for detailed summaries of all 2024 BOS meetings to date. Also, access the (UNOFFICIAL) 2024 BOS Voting Record.

Agenda Items, Discussions, Decisions, and More

- Reports of Committees, Boards and Commissions

- Reports of Officials

- Engineer’s Report

- Solicitor’s Report

- Manager’s Report

- Other Items of Interest

|

Scooped by johnmacknewtown |

Managing Growth and Development: Housing Projections Analysis

The 109-page FINAL DRAFT of the 2024 Newtown Area Comprehensive Plan (“the Plan”; LINK: https://tinyurl.com/FinalDraftCompPlan) was approved for advertising by the Newtown Township Board of Supervisors at its March 27, 2024, meeting (LINK: TBD). Other members of the Jointure – Wrightstown and Upper Makefield – are expected to do the same, if they have not done so already.

The Plan was developed by the Bucks County Planning Commission (BCPC), and current version dated 2/27/24 is the result of several years of back and forth deliberations among Jointure members. Its purpose is to address the challenges faced by the members. The Plan, which contains nine guiding principles for the future, is a blueprint for the future.

Each Jointure municipality will hold a public meeting to answer questions and hear comments from residents. Newtown Township’s plans to include this at its May 22. 2024, Board of Supervisors meeting.

In order to help Newtown Township residents prepare for the scheduled May 22, 2024, meeting, I hope to prepare several short synopses of major sections of the Plan. This first synopsis focuses on:

Principle #1 - PROMOTE SMART GROWTH

Read the analysis in Newtown Patch...

The goal of the Plan developers with regard to housing, as it was explained to me at a Jointure meeting, was to determine if the Jointure had enough open space where housing is permitted to accommodate the projected population growth. The answer was yes. They used a figure of 224 new residents for Newtown by 2030. This number was from DVRPC; Delaware Valley Regional Planning Commission and is based on 2020 Census data analysis. However, what comes first? The chicken (people) or the eggs (developers getting their way)? That is, if you build it, people will come. Although the planners (BCPC) think there is enough available space WITHOUT changing the zoning, they also suggest that zoning be changed to allow more housing (e.g., in the OR and OLI/LI districts which ONLY exist in Newtown). How can this be a plan to promote "smart growth?"

Perhaps the "Smart Growth" section needs an update...

Related Content:

- “The #NewtownPA Area Joint Comprehensive Plan is Ready for Review by Jointure Planning Commissions”; https://sco.lt/61Xmam

- “Newtown Planning Commission Members Discuss Projects Related to the Comprehensive Plan”; https://sco.lt/9HdGme

- “Guiding Principles of the New #NewtownPA Area Comprehensive Plan: Recognizes "Threat" of Climate Change”; https://sco.lt/685MS8

- “Jointure Comprehensive Plan Survey: Summary of Responses From Newtown Township Residents”; https://sco.lt/7bBrOK

|

Scooped by johnmacknewtown |

Seven #NewtownPA Twp residents and one Middletown resident attended this Zoom meeting, which focused on License Plate Reader cameras, removing PFAS from drinking water, Roberts Ridge Park meadow plan, Comprehensive Plan, LDR Trail guiderail problems, and more...

- Opening Presentation

- Further Discussion and Details

- Links to Important Information

- Detailed Meeting Notes

|

Scooped by johnmacknewtown |

Welcome to the March 25, 2024, Meet Mack Monday Zoom meeting presentation! I’m John Mack, your host and a Newtown Township Supervisor.

The goal of Meet Mack Monday Zoom meetings is to inform residents of township issues that impact them and to get feedback and comments from residents about such issues. This helps me keep better informed of residents’ concerns when I vote on the issues at Board of Supervisors meetings.

TOPICS COVERED:

• License Plate Reader Cameras Approved

• Newtown Artesian Water PFAS Filtration Plan

• Roberts Ridge Park Lawn to Meadow Conversion

• Proposed Durham Rd Day Care & Medical Buildings

• Dealing with Trash on the Trail

• Comprehensive Plan Update

• Washington Crossing Bridge Replacement Plan

• Problems with the LDR Trail Guiderail

Download the PPT Notes: https://rebrand.ly/25mar24mmmNotes

See a summary of the meeting that includes audio clips of discussions with attendees on these subjects: LDR Trail Guiderail Problem, Roberts Ridge Park Lawn to Meadow Conversion, Washington Crossing Bridge Replacement, Nixle Alert Application

|

Scooped by johnmacknewtown |

#NewtownPA Supervisors Approve 2024 Road Repair Program

UPDATE 3/27/24: The Newtown Township Supervisors approved the 2024 Road Program.

Joseph Schiavoni, Director of Public Works, has evaluated the bids and has put a paving package together to remain under the budgeted amount. The township had allocated $755,000 in the budget for paving to be paid by the General Fund, Highway Aid Fund, and American Rescue Fund.

This item was included in the 27 March 2024 BOS meeting under the Engineer’s Report. The Supervisors unanimously approved the Program.

The recommended paving includes (see map):

Base bid:

- Eagle Rd. (portion), Farnsworth Way, Ashford Way, N&S Ascott Ct., Amaryllis Ln., Lotus Pl., Campus Dr; $542,114.10

Alternate bids:

- Alt #2 Cypress Place; $70,660.00

- Alt #3 Coachwood Ct; $43,005.45

- Alt #4 Mulberry Pl; $24,053.65

- Alt #5 Monterey Pl; $30,890.05

- Alt #6 Mahogany Walk; $33,783.80

For a total of $744,507.05

This totals 1.99 miles of township roadways. Note that there are approximately 71 miles of township roads requiring repaving every 20 years. Therefore, to merely keep up with current roadway conditions 71/20 or 3.55 miles of roads should be repaved per year. At this rate, the township is falling behind at about 1.5 miles of roads per year needing repair but not getting it!

Related Content:

I am disappointed that Wexley Drive, which was an alternative bid item (see below), in my development was not included.

The Contractor - James D. Morrissey Inc. - submitted their bid for the Base Bid work in the amount of $542,114.10, for the various Alternate Bids as follows:

Alternate Bid No. 1 – Cliveden Drive $62,787.00

Alternate Bid No. 2 – Cypress Place $70,660.00

Alternate Bid No. 3 – Coach Wood Court $43,005.45

Alternate Bid No. 4 – Mulberry Place $24,053.65

Alternate Bid No. 5 – Monterey Place $30,890.05

Alternate Bid No. 6 – Mahogany Walk $33,783.80

Alternate Bid No. 7 – Wexley Drive $77,437.00

Alternate Bid No. 8 – Meridian Circle $94,488.00

Alternate Bid No. 9 – Remy Place $42,300.15

Alternate Bid No. 10 – Leslie Place $34,845.50

Alternate Bid No. 11 – Andover Place $31,545.40

Alternate Bid No. 12 – Carmel Place $39,027.45

Alternate Bid No. 13 – Derby Place $35,829.30

Alternate Bid No. 14 – Adrian Place $36,421.70

Alternate Bid No. 15 – High Street $95,637.75

Alternate Bid No. 16 – Willow Court $73,151.50

Alternate Bid No. 17 – Union Street $114,182.00

Alternate Bid No. 18 – Jasmine Court $45,299.25

Alternate Bid No. 19 – Thistle Lane $19,220.80

Alternate Bid No. 20 – Bucks Meadow Lane $115,534.25

Alternate Bid No. 21 – Chandler Field Parking Lot $25,099.00

|

Scooped by johnmacknewtown |

This is my personal summary of the 19 March 2024 Newtown Planning Commission Meeting. This is NOT a complete nor is it an official summary.

The Agenda included the following:

- Newtown Artesian Water Company, 251 Frost Lane

- Final Review of Comprehensive Plan Update

- Proposed Day Care Center & Medical Office on Durham Rd

Note that the BOS expressed concerns about previous plans for this parcel.

Related Content:

- “#NewtownPA Supervisors Defend Zoning, Oppose Variance For New Daycare, Medical Office”; https://sco.lt/7h2s1Q

- “Newtown Supervisors Oppose Plan To Build 27 Townhouses at 413 Durham Road”; https://sco.lt/4y2jyq

- “It's Strike Two for 27 Townhomes on Durham Road!”; https://sco.lt/5To9Bo

|

Scooped by johnmacknewtown |

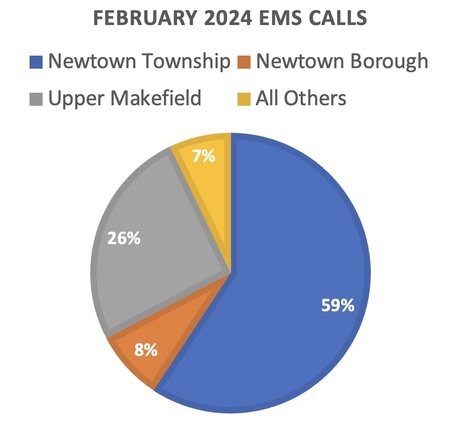

February 2024 #NewtownPA EMS Report

Due to system problems in the aftermath of the January cybersecurity incident at the County, mutual aid statistics for Newtown Ambulance services (NAS) that responded in to the Township is not yet available.

This month‘s report has been generated based on NAS's internal systems and a dispatch report provided by the County EHS Office..

TOTAL RUNS: 211

Note that we count every vehicle response as an individual run. The County on|y counts number of incidents, not number of responses. Total run numbers are based on the total number of reports in the NAS internal system.

|

Scooped by johnmacknewtown |

At its 19 March 2024 public meeting, Newtown Planning Commission gave its unanimous support to the Newtown Artesian Water Company (NAWC) and its plans for a building addition at its plant on Frost Lane to filter out harmful PFAS contaminants from the system’s drinking water.

The company is seeking a special exception and variances to build a 2,000-square-foot, two-story addition onto its Utility Operating Facility, including related driveway and parking improvements.

With PFOS and PFAS contamination spreading out from the Willow Grove Naval Air Station to Montgomery and Bucks counties, the Newtown water system is planning to add a new filtration system.

[See this NAWC Q2 2022 chart (the latest I have) showing PFAS levels in its water wells: https://sco.lt/7eob8i]

“We need a rear yard variance for the addition. There’s a 60-foot requirement. We’re about 36 feet. There’s also a 50-foot buffer on top of that for the driveway and the building," NAWC told the planners. "We asked for a height variance so that we could design an addition that looks more residential and in keeping with the neighborhood. It’s not something you’re going to readily see from the road but we thought the effort was worth it."

The utility said the relief being requested from the zoning board is the minimum necessary "to afford reasonable use of the property considering the existing and threatened contamination of the public water system. What is proposed is in keeping with the character of the neighborhood ... What is proposed is not adverse to public health, safety and welfare, but in furtherance of it."

Construction is scheduled to begin in 2025 with an opening in 2026.

Related Content:

- See the Plan; https://rebrand.ly/z1telya

- “#NewtownPA Artesian Water Company Plans a Filtration Facility to Remove PFAS from Drinking Water”; https://sco.lt/5DJKfQ

- “New Proposed PA Legislation Aims To Further Reduce Cancerous Forever Chemicals (PFAS) In Drinking Water”; https://sco.lt/7sp1ii

- “U.S. EPA Proposes New LOWER PFAS Levels for National Primary Drinking Water Regulation”; https://sco.lt/7sp1ii

- “EPA PFAS Fact Sheet”; https://www.epa.gov/system/files/documents/2022-06/drinking-water-ha-pfas-factsheet-water-system.pdf

|

Scooped by johnmacknewtown |

wIn order to have a rain water drainage system separate from the sewer system, the Township must have a plan to reduce rain water drainage into the streams, which can become polluted when the rain water carries in pollutants.

To do this, the Township came up with a pollution reduction plan to convert some open fields to meadows that will absorb rain water before it can enter the streams. The open fields at Roberts Ridge Park are key components of that plan.

Regarding this plan, the PA Department of Conservation and Natural Resources (DCNR) sent this message to the #NewtownPA Township Manager:

"PA DCNR is inching closer to advertising your lawn conversions for public bid." NOTE: This includes the conversions planned for Roberts Ridge Park (see image). This was a bone of contention among residents who demanded - and eventually got - a change in the plan that would preserve the open field that is often used. For more on that, read "Supervisors Approve REVISED Pollution Reduction Plan."

"The speed bumps have been their own execution of grant funding contracts and legal review of landowner agreements," said DCNR. "I’m told they fully expect work to begin – turfgrass kill – later this summer for a fall seeding. Worst case scenario is preparation and seeding spring 2025."

"So, as the grass starts to grow, please mow. I cringe just a little bit but if you stop mowing, in invites invasive weeds to grow and seed, exactly what we don’t want to happen."

This was discussed at the March 25, 2024, Meet Mack Monday...

Prior to this, the DNCR was sent the original plan. Luckily the revised and APPROVED plan was sent to them. As I said in my response:

"Please ensure that whoever does the work kills the grass and reseeds in the PROPER APPROVED locations in the park. I say this because we were previously notified that the plan submitted to the DCNR was not the right plan. DO NOT MESS WITH THE OPEN FIELD AREA!"

Related Content:

- "Residents Want to Dump Meadow Conversion Plan," Says Bucks County Herald. Not True, Says Mack!”; https://sco.lt/5tyoKG

|

Scooped by johnmacknewtown |

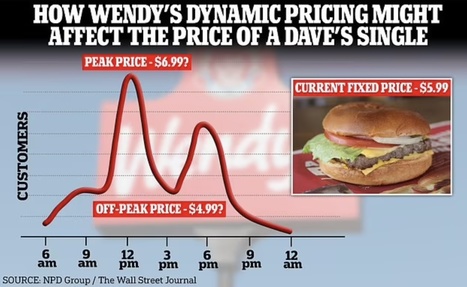

In late February 2024, news broke that [Wendy’s] was considering charging different prices at different times of day — a tactic usually associated with airlines and ride-hailing companies.

[On February 15], Wendy’s announced a multimillion-dollar investment to roll out digital menu boards across all its U.S. stores. This investment would support “dynamic pricing and menu offerings,”

“Beginning as early as 2025,” said Wendy’s CEO, “we will begin testing more enhanced features like dynamic pricing and day-part offerings along with AI-enabled dynamic pricing menu changes and suggestive selling.”

See my insights below for why this may be prohibited in Newtown Township...

Whenever digital signage such as "digital menu boards" are mentioned, my ears perk up. It's perfectly fine for Wendy's or any other drive-thru takeout business - such as Chick Fil-A - to have digital menu boards inside the establishment, but in Newtown Township these would be prohibited in outside signage such as menu boards at the drive-thru entrance.

That's because the Joint Municipal Zoning Ordinance (JMZO) specifically prohibits "Electronic Message Centers" (EMCs). EMCs include computer programmable, microprocessor controlled electronic or digital displays. EMCs are prohibited in all zoning districts within the Township.

Related Content:

- “Mack Requests That the #NewtownPA Area Joint Zoning Council Fix Problems With the JMZO Signage Ordinance”; https://sco.lt/8xsp4i

-

“Newtown Township Versus Wawa: Round 1, Signage”; https://www.johnmacknewtown.info/zhbwawarnd1.html

- “#NewtownPA ‘Neon Signage Armageddon’?”; https://sco.lt/74Ysme

|

Scooped by johnmacknewtown |

The next Meet Mack Monday Zoom meeting is scheduled for March 25, 2024, starting at 7 PM. Some madness may be involved. See what's on the agenda and the login info below.

The Tentative Agenda

A 15-minute Presentation

- License Plate Reader Cameras Coming – Do you have my data now? What happens to YOUR data?

- Newtown Artesian Water Company – Plan to deal with PFAS in our drinking water

- Comprehensive Plan Update – Your chance to see some details before most other people!

- Washington Crossing Bridge – Details regarding the plan to REPLACE it

- Child Care Facility and Medical Office (413 Durham Rd) – What's the Planning Commission's opinion?

- Repair and Relocation of LDR Guiderail - Why the delay?

Privilege of the Floor

Discuss whatever is on your mind.*

RSVP to let me know what issues should be covered at my next Meet Mack Zoom meeting on March 25, 2024, starting at 7 PM. See below for possible discussion topics. Upon completion of this form you will be shown the login information. Even if you cannot attend, I will send you links to the discussion and background information.

This is not an official Newtown Township meeting. It is hosted by Newtown Supervisor John Mack to learn more about issues of concern to Newtown Township residents and to share ideas on important issues.

|

Scooped by johnmacknewtown |

Topics include:

- Wawa coming soon to Bypass

- Jointure will allow 5G antennas

- NAACP race and policing report

- ED streetlight payback period disputed

- more...

Read the entire issue online here: https://www.johnmacknewtown.info/noimar24.html

|

Scooped by johnmacknewtown |

It was a beautiful night, so the room was virtually empty except for one resident who really had nothing to say about the issues being decided, which included:

- Approving spending $151,00O in grant money to fund a License Plate Reader system of cameras throughout Newtown Township and Wrightstown. Are you aware of the privacy issues? I asked questions of Chief Hearn. Wish you were there to hear his answers! Oh well, read my notes...

- Holding the LDR Trail contractor [Associated Paving] responsible for fixing and relocating the guiderail because of their errors; i.e, the section of guiderail that needs to be relocated is between Everett and Yorkshire. Because of a conflict with the gas utility, the Contractor installed the guiderail within the trail, where it should be further into the roadway. Will we have to hire them for future projects if they submit the low bid? That's my question!

|

Scooped by johnmacknewtown |

License Plate Readers Coming To 4 Newtown-Wrightstown Intersections - Newtown, PA - The system will cost the township $151,000 to install. The cost will be fully funded and reimbursed through a grant.

Cameras, mounted on the mast arms of the traffic signals, will capture the license plates of every vehicle passing through the intersections, flagging any that are in the NCIC, a national criminal justice database, according to Police Chief John Hearn.

"Wanted subjects, missing persons, stolen license tags, Megan's Law violations, terrorist watch lists. That's what the database searches out," said the chief.

According to Chief Hearn, license plate images will be retained for 30 days. "If it doesn't hit, it disappears in 30 days. If I get a hit on your license plate as unregistered, it will stay in there for 60 days. If there's a criminal investigation on the license plate we're going to keep it indefinitely until the case is closed."*

The proposed locations of the LPR in Newtown/Wrightstown are:

- NEWTOWN BYPASS AND DURHAM ROAD

- SYCAMORE STREET AND SWAMP ROAD

- DURHAM ROAD AND 2ND STREET PIKE

- NEWTOWN BYPASS AND RICHBORO ROAD

I'm happy that the Chief specified what happens to license plate/car location data captured from law-abiding abiding citizens. This was one of my concerns (for more on that read "“#NewtownPA Township Police Department Requests BOS Approval to Purchase License Plate Readers for $151,000!"; https://sco.lt/7y3KSG).

*Let's hope that this policy is followed.

|

Scooped by johnmacknewtown |

A major intersection upgrade is scheduled to begin on Monday at Lincoln and Washington Avenues.

In December, the borough council awarded a $500,473 base bid to Armour & Sons Electric for an upgrade to the busy intersection.

The project will include the replacement of antiquated standards with new poles and signal heads, new LED countdown pedestrian signals and pavement markings, and the construction of new ADA (Americans With Disabilities Act) curb ramps.

Among the new pedestrian accommodations will be a leading pedestrian interval (LPI), which will allow pedestrians to enter the crosswalk 3 to 7 seconds before vehicles are given a green indication. The LPI allows pedestrians to better establish their presence in the crosswalk before vehicles are given the go-ahead to turn right or left.

Meanwhile, the planned Newtown-Yardley Road and Tara Drive Crosswalk Improvements have stalled. According to comments from a resident:

“This period of time with No Reportable Activity or Progress by RVE is 68 days delay to a safer Pedestrian Crosswalk for Newtown!"

Residents were advised by the Township Maanger to contact their state represntatives.

Ms. Valerie Malek emailed State Senator Steve Santarsiero and Representative Perry Warren::

“We seem to have hit a “bump in the road” with moving our pedestrian crosswalk safety initiative forward. Your help is extremely needed.

“We need both of your offices to inquire why there is this delay with PennDot.

“As you know a group within the Newtown Walk Community has worked tirelessly for what will soon be two years to keep all pedestrians safe when they use the midblock Newtown Yardley Rd/Tara Blvd crosswalk. We need this project to keep moving forward for the safety of Newtown residents. PennDot’s delaying this process is unacceptable.”

|

Scooped by johnmacknewtown |

Why the Rising Cost of Trash Pickup in Bucks County? What Some Municipalities Pay

[From phillyburbs.com, Mar 13, 2024]

'Sticker shock' for Bucks County towns bidding trash contracts since pandemic. Here's why

Bucks County residents and municipalities are finding that since the pandemic, trash removal has gotten quite expensive.

In Bristol Borough, Manager James Dillon said the cost of trash collection went up 70% in the past year after it had been stable for several years under a previous contract that began in 2016.

The increase is hitting or will hit many municipalities as they end long contracts that were signed before 2020 and COVID, and by post-pandemic impacts on costs that often are passed to residents through taxes and fees.

Some in Bucks County also pay for their own trash pickup and those contracts are also on the rise, industry officials said.

Bristol's seven-year long contract with J.P. Mascaro & Sons expired last year and Mascaro was the lowest bidder to renew the contract which provides trash removal service two days a week, with recyclables picked up one day per week per household.

But the rates went up from $395 to $675 per unit per year, Dillon said.

Middletown Township provides two-day-a week service to its residents through its contract with Waste Management.*

Another trash hauler, McCullough Rubbish Removal of Morrisville, said it only deals with individual clients, working in municipalities where people pick their own trash removal service, like Lower Makefield.

#NewtownPA does not provide trash pickup. Residents such as myself - who uses WM - pay as much as $100 per quarter ($400 per year) for ONE-DAY-A WEEK service, which is a bit challenging for us retired folk. Must be even more challenging for families with young children. It is uncertain if this price will increase.

Some municipalities offer discounts for seniors.

Related Content:

-

“Single Hauler Trash Pickup Survey Results”; https://www.johnmacknewtown.info/blog/?viewDetailed=202306080126

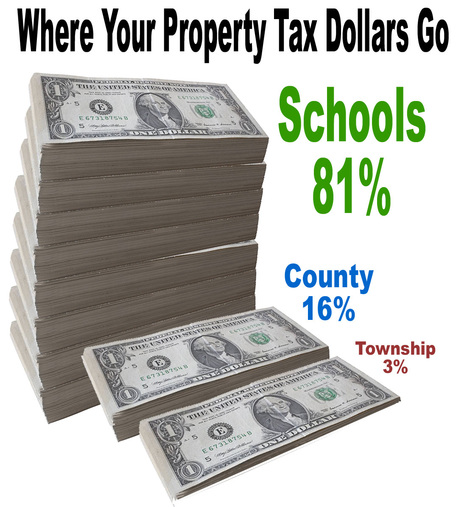

In 2018, for the first time in several years, Newtown Twp raised taxes by 1 mill - about $38 per year for average homeowner. Learn where your tax dollars go here.