The elephant in the official Newtown Township Citizen Survey, which closed on July 9, 2020, is Question 15: "Would you be willing to pay higher Township taxes for increased services?"

In light of the projected COVID-19 caused loss of Earned Income Tax (EIT), which accounts for more than 60% of general funds revenue, the wording of Question 15 might better be "Would you be willing to pay higher Township taxes to prevent cutbacks in current services?"

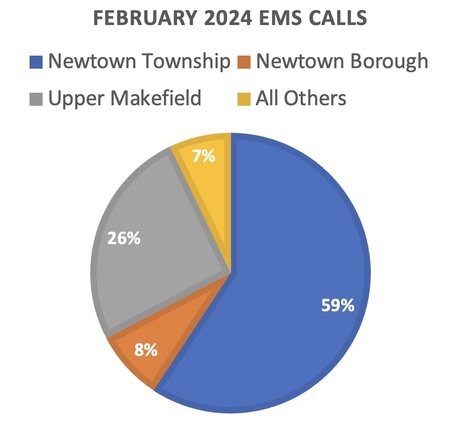

It should be noted that Newtown Township has one of the lowest property taxes in the area. The Township's 4.5 mill tax amounts to $196.20 yearly town tax on a home with a market value of $400,000 and an assessed value of $43,600 (the approximate average home market/assessed value in Newtown Township in 2018). None of the tax money collected is deposited in the General Fund, which pays salaries of the Police, Public Works, EMS and other township departments as well as other expenses such as legal fees, etc.

Your new post is loading...

Your new post is loading...

How to Fix Newtown's Budget Deficit: Cut Spending, Increase Productivity, Raise Taxes or All of the Above?

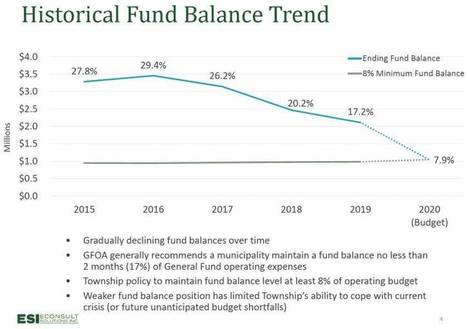

The Newtown Township Board of Supervisors (BOS) engaged Econsult Solutions, Inc. (ESI Solutions) to develop a comprehensive multi-year financial management plan. This effort is partially funded by a Strategic Management Planning Program grant awarded by the Pennsylvania Department of Community and Economic Development (read "Newtown Applies for DCED Grant to Assess the Township's Financial Condition"). A five-year plan, including recommendations to improve operational efficiency and promote fiscal stability in Newtown Township, will be publicly released later this year.

UPDATE (9/8/20): At the August 31, 2020, [Act32Bucks] Bucks County Tax Collection Committee meeting, Joseph W. Lazzaro, who represented Keystone, which collects EIT, reported that for Bucks County as a whole EIT collections are down by only $13,000 compared to 2019 which was a banner year. Mr. Lazzaro anticipates that by end of that today all this and more will be collected.

Obviously, results depend on local residents. Mr. Lazzaro pointed out that if a collector area (e.g., school district or township) has a lot of employees who work in the restaurant industry then EIT will be impacted more than if residents worked in healthcare and the pharma industry (which is more like Newtown). He even suggested that the latter type of employee may be making more money this year than last year and thus be paying more EIT offsetting any loses from other more vulnerable employees.

Related Content

How Satisfied Are You With Newtown Township Services?

ESI COVID-19 Financial Impact Report

How's the Newtown Township Financial Garden Doing?

Andrew Sheaf Talks About DCED's Early Intervention Program