A Five Year Financial Plan commissioned by the township is recommending a tax increase in 2021 to make up for a loss of revenue and to begin exploring cost sharing opportunities with neighboring Newtown Borough.

Steve Wray, from Econsult Solutions, briefed the board of supervisors on the report’s preliminary findings and recommendations during an August 17 work session.

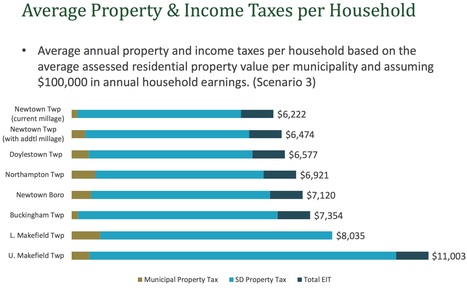

In its report, Econsult outlines major recommendations to improve the township’s financial condition over the next five years, beginning with the addition of real estate tax millage [+4.7 to +7.0 mills were proposed] to the general fund budget beginning in 2021 “to help diversify and broaden the base of revenues and also to make up revenues lost in the earned income tax.”

UPDATE: On September 23, 2020, the consultants presented an updated final version of its recommendation that RE taxes be increased by 7.25 Mills in 2021 and the hiring of 8 new personnel - including 5 career firefighters - in 2021 and an additional 2 police officers in 2022. More...

In addition, it recommends adjusting staffing levels to meet the current management needs of the township, including hiring an assistant manager and code enforcement officer; bringing the police force up to full complement with three new officers while reducing or eliminating overtime and comp time; and hiring five new career firefighters through a federal grant.

The township was carrying a high fund balance of 30 percent in 2015-16. By the end of this year it is projected to be eight percent. “What we’re seeing is a weakening fund balance position. And we would see that going forward if no changes are taken,” he said.

Generally, the Government Finance Officers Association (GFOA) recommends a municipality maintain a fund balance of no less than two months or 17 percent of general fund operating expenses. “You guys just have just adopted a measure to keep it at 10 percent. We think that’s a good idea and a very positive move,” said Wray.

Comparing the township to its neighbors, Wray said Newtown Township has the second lowest real estate millage rate. And the township’s millage increases have been consistent with the average increases across the municipalities.

Projecting ahead over the next five years, Wray said if nothing changes the township will continue to see “a growing spread” between revenue and expenditures with the fund balance projected to fall below 10 percent by the beginning of 2021 and continuing to decline through 2025 as it’s used to fund the widening gap.

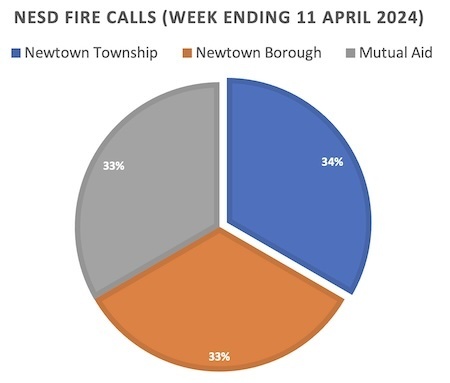

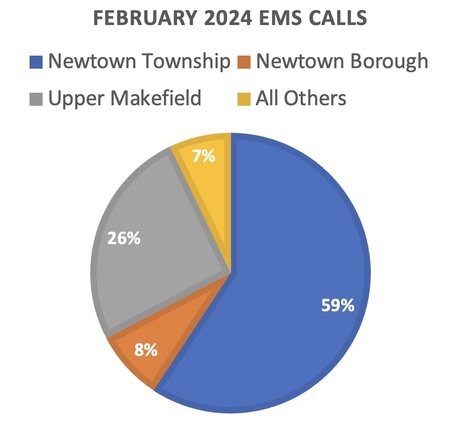

The report also recommends the hiring of five career firefighters through a federal SAFER grant that would initially pay salaries and benefits over the first three years. As the grant expires in years four and five, Wray said regional cost sharing opportunities could make up the difference.

Your new post is loading...

Your new post is loading...

One of the reasons given to raise taxes is to maintain a healthy General Fund Reserve, which was predicted to take a hit due in part to lost Earned Income Tax (EIT) collection caused by the COVID-19 closure of businesses and subsequent unemployment increase. However, the anticipated decrease in EIT never happened - in fact EIT collection increased 4.8% in 2020 vs 2019 (a "banner year").

UPDATE from KEYSTONE, which collects EIT:

At the close of August 2020, Bucks Tax Collection District (TCD) ended up with an increase of about $1.6 million from 2019. As it stands now, the TCD as a whole is up a little over $55,000.00 in 5th quarter money! Comparing earned income collections for 1/1/20 – 8/31/20 vs 1/1/19 – 8/31/19, Newtown Township specifically is up about $258,000.00 or 4.8%.

Related Content: