Get Started for FREE

Sign up with Facebook Sign up with X

I don't have a Facebook or a X account

| Tags |

|---|

Your new post is loading... Your new post is loading...

Your new post is loading... Your new post is loading...

Prentiss & Carlisle is one of the largest timberland asset managers in North America. P&C provides ongoing management services on approximately 1.75 million acres of timberland located in Maine, Michigan, New York, Vermont, Wisconsin, Ontario and Quebec. Nearly every acre under management is certified by the Forest Stewardship Council through either our clients or through P&C itself, which holds FSC certificates for both Forest Management and Chain-of-Custody.

P&C provides turnkey land management from long-range forest planning through on-ground forestry, marketing of forest products, harvesting, transportation, road construction and maintenance, stump-to-mill accounting and reporting, client cash management, administration of third-party relationships, public advocacy/representation and strategic asset planning. P&C also provides specialized consulting services in related areas of expertise:

About this magazine Our aim is to provide a gathering place for news and opinion about timberland investing. We cover both publicly traded issues including listed timber companies, real estate investment trusts (REIT's), and exchange traded funds (ETF's), and the more private world of institutional investing in timberland. Our focus is on: the rationale for investing in timberland; performance of publicly traded timber investments; timberland deals and transactions; timber supply, demand and prices, and; public policy issues that impact timberland investing. Not interested in all of these topics? You can easily filter the stories by using the Tags button above.

We encourage readers to interact with our site:

Some useful links

Stock quotes, news and financial metrics These links take you to customized Google Finance pages for timber REITS, indexes and other publicly traded companies of interest:

Prentiss & Carlisle newsletters Quarterly updates on conditions in our operating regions

Lake States price reporting service published by P&C

Qtf Homes's comment,

November 11, 2022 4:55 AM

Timber Frame company QTF Services build and deliver and house kits packages throughout UK and Ireland. Quality controlled manufacturer following ISO standards.

https://www.qtfhomes.co.uk/

Interest in sustainable and impact forestry investing has been growing steadily over the past two decades, according to a new report by The Global Impact Investing Network (GIIN) titled “Scaling impact investing in forestry”.This presents an opportunity for impact investors to push for social and environmental change in the forestry asset class.Sustainable forestry projects adhere to commonly accepted certifications such as those by the Forest Stewardship Council and the Sustainable Forestry Initiative. This balances the needs of the environment,

From

www

More people are working in Wisconsin's forestry industry, and Wisconsin timber is fetching millions more on the market than it did even a few years ago.

Overall, Acadian Performed well operationally which led to solid results for the 2018 year. During the period, Acadian generated adjusted EBITDA of $22.1 million which compared to $23.3 million during 2017. The strong demand and pricing Acadian experienced in the first half of 2018 reflecting the favorable dynamics of the Northeast regional log markets carried through the second half of the year.

The president is intent on pushing up timber sales in spite of the government shutdown.

There’s been no shortage of coverage on the tragic and personal losses survivors of Hurricane Michael are experiencing, but the storm is also causing an economic crisis for some in the state's poorest counties.

The back roads of Liberty and Calhoun counties in Florida’s Panhandle look like a bomb has gone off.

Calhoun County lost 90 percent of its timber. The short term problem is getting the trees off the ground.

“To put it in perspective, we estimate that there is roughly the equivalent of 2.5 million truckloads of timber laying on the ground. It could be as much as a 20-year supply of wood laying there,” said Florida Commissioner of Agriculture Adam Putnam.

The trees have been down 60-plus days and the clock is running on how long the downed trees can be salvaged.

“We’ll only be able to use the timber for a certain amount of time and then it will be pulpwood,” said Timber Consultant Virgil Shannon.

"You know, somewhere around six to nine months before the bugs move in,” said Putnam.

A total of 7 643 hectares of predominantly pine plantations belonging to private timber growers in the Southern Cape region have either been totally or partially destroyed in the fires that raged in the Outeniqua mountains between 25 October and 16 November. Plantations ranging in age from one to 25 years were affected.

These were the findings of a meeting of 35 people involved in the timber and timber processing industries, held at the Nelson Mandela University in George on 3 December.

This will have a major negative influence on the future ability of the forestry industry in the region to produce the timber needed to supply the processing plants reliant on this resource.

The value of the timber lost has not yet been completely established, as many factors need to be taken into consideration. The cost of re-establishing those areas that have been totally destroyed has also not been established accurately. However, initial estimates are that just the re-establishment costs could be in the region of R80-million.

Furthermore, many jobs in the timber-growing sector will be permanently lost. Forestry infrastructure was also destroyed. The processing side of the industry in the region has the potential to process approximately 700 000m³ of logs per annum, the majority of this through sawmills and pole treatment plants.

The Fourth National Climate Assessment focuses on human welfare, societal, and environmental elements of climate change. It lays out the devastating effects on the economy, health, environment, and wildfires. Within the 1,656-page document wildfires are covered extensively.

The scientists conclude that by the middle of this century, the annual area burned in the western United States could increase 2–6 times from the present, depending on the geographic area, ecosystem, and local climate. The area burned by lightning-ignited wildfires could increase by 30% by 2060.

In the Southeast rising temperatures and increases in the duration and intensity of drought are expected to increase wildfire occurrence and also reduce the effectiveness of prescribed fire. Intra-annual droughts, like the one in 2016, are expected to become more frequent in the future. Thus, drought and greater fire activity are expected to continue to transform forest ecosystems in the region.

In the Southwest, recent wildfires have made California ecosystems and Southwest forests net carbon emitters (they are releasing more carbon to the atmosphere than they are storing). With continued greenhouse gas emissions, models project more wildfire across the area. Under higher emissions, fire frequency could increase 25%, and the frequency of very large fires (greater than 5,000 hectares) could triple.

The Northwest is likely to continue to warm during all seasons under all future scenarios, although the rate of warming depends on current and future emissions. The warming trend is projected to be accentuated in certain mountain areas in late winter and spring, further exacerbating snowpack loss and increasing the risk for insect infestations and wildfires. In central Idaho and eastern Oregon and Washington, vast mountain areas have already been transformed by mountain pine beetle infestations, wildfires, or both, but the western Cascades and coastal mountain ranges have less experience with these growing threats. Forests in the interior Northwest are changing rapidly because of increasing wildfire and insect and disease damage, attributed largely to a changing climate. These changes are expected to increase as temperatures increase and as summer droughts deepen.

Climate change often conjures up images of heat, drought and hurricanes. But according to the latest U.S. National Climate Assessment, released on Nov. 23, 2018, winters have warmed three times faster than summers in the Northeast in recent years. These changes are also producing significant effects. Historically, over 50 percent of the northern hemisphere has …

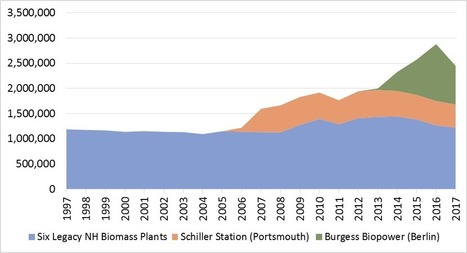

Biomass fuel is an important market for New Hampshire’s forest industry and, despite recent victories in the state legislature, six legacy biomass plants now face a new challenge that threatens their ability to continue operations.

While they comprise an important market for the state, New Hampshire’s smaller biomass plants have a hard time operating in the highly competitive wholesale energy market. In 2008, the average price for wholesale electricity in New England was $80.56 per MWh; in 2017 it dropped to $33.94 per MWh (up from $28.94 per MWh in 2016). Decreased natural gas prices coupled with increased efficiency at homes and businesses has been great for forest industries that purchase electricity, but it also threatens the continued operations of some biomass plants. *** In September, the 400-member NH House overrode the governor’s veto by just one vote, apparently securing the near-term future for these biomass markets. ***

Two basic sales models exist for individuals and companies that own and manage timberland for profit in the US South:

***

Timber sale levels on the Chequamegon-Nicolet National Forest reached 128.7 million board feet in fiscal year 2018, a level of sales not seen since the early 1990s. |

The majority of the nation’s forests (443 million of 766 million acres) are in private ownership.

Many of the world’s largest institutional investors are moving closer to their portfolio allocations for real estate assets, which may slow the pace of their property acquisitions, according to a new report.

MADISON, Wis. (AP) - Timber sales are increasing in Wisconsin and more people are working in the state's forestry industry, according to a new national study.

The Wisconsin Natural Resources board unanimously approved spending $4.8 million to buy a conservation easement on more than 14,000 acres of forest land in Iron County.

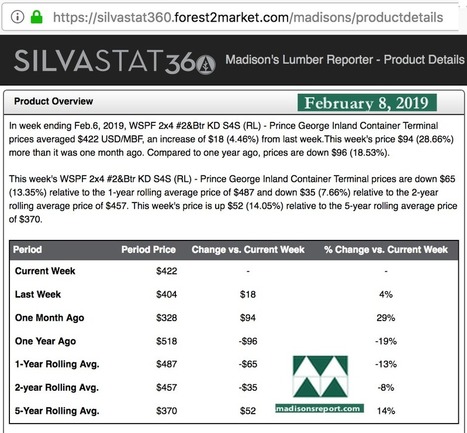

The spectacular rebound of North American construction framing dimension softwood lumber prices in early February continued as prices rose in response to transportation problems, mostly on Canadian railways. Severe weather hit many parts of Canada and the US, causing delays of shipments from softwood lumber suppliers.

The federal court-appointed receiver in a $100 million Mississippi Ponzi scheme case is holding the state's most prominent law firm and others responsible for "contributing" to its facade out of a desire for profits.

The Forest Department under the Ministry of Natural Resources and Environmental Conservation has been planning to permit the export of logs harvested from private timber plantations, U Tin Tun, director of the Forest Department, told The Myanmar Times.

To protect the environment and prevent deforestation, Myanmar in April 2014 banned the export of whole logs and raw timber, leading to a substantial decline in export revenues over the past few years.

In July this year, the government proposed allowing the export of logs grown by private investors such as sawmills. “Our aim is to attract investments in private timber plantations. Allowing exports is one way to incentivise investors in this segment,” said U Tin Tun. *** In Myanmar, private forest areas consist of teak, hardwood and industrial crop plantations. Some 300 private timber plantations have been allowed to harvest timber over 250,000 acres of private forest. Over 140,000 acres had been developed as at March this year, according to the Forest Department.

Before 2015, Myanmar allowed local businesses to develop commercial timber plantations on 500 acre of private forest lands for teakwood plantations, 200 acres for industrial plantations and 100 acres for hardwood plantation.

Since then, the Forest Department has permitted larger scale plantations of over 1000 acres to be developed on private forest land by both local and foreign investors. Land is awarded to private plantations via an open tender process.

So far, there have been a total of six local and foreign investments in large-scale plantations.

According to the Myanmar Investment Commission, foreign investors such as sawmills are required to produce and grow their own supply of timber. Approvals for such investments are to be obtained from the Ministry of Natural Resources and Environmental Conservation.

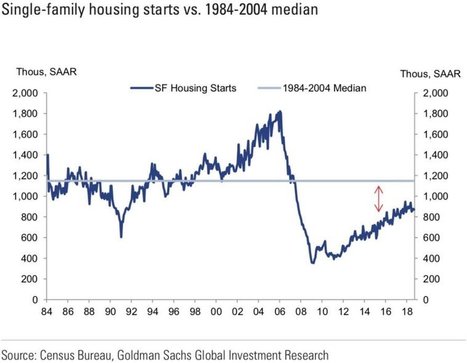

The US housing sector—a bellwether for economic health—has showed signs of stagnation (and even the prospect of reaching peak housing in this market cycle) in recent months. As I wrote last month, forecasts for housing starts are simply overblown, as there isn't much room for an increase beyond the 2018 level of 1.266 million units.

As a commodity largely tied to housing starts and broader building and construction activity, lumber prices also reflect the general health of this market via supply and demand metrics. After steady increases beginning in 4Q2017, lumber prices skyrocketed to new record highs in 2Q2018 before dropping precipitously across the board over the last four months. Southern yellow pine (SYP) lumber prices recently hit their lowest point since August 2017; Forest2Market’s SYP composite index price for mid-November was $376/MBF—a 35% drop from the record high of $576/MBF achieved in May.

Despite the one–two hurricane punch that recently impacted the US South and the continued wildfires in the Pacific Northwest (PNW)—extreme weather events that have significantly impacted forest inventories, harvests and supply—the drop in lumber prices over the last six months is largely, though not entirely, demand driven. Fewer new-home builds = less lumber.

The sudden reversal begs a serious question: Did the lumber market simply over drive its headlights in the price run-up earlier this year, or are there more structural forces at work? Several dynamics are combining to impact housing starts and, by extension, the North American lumber market.

It is clear that the irregular peak that occurred from May-August was an anomaly likely driven by speculation around uncertain trade policies, overly optimistic housing start numbers and the likelihood of pinched lumber flows from Canada and the timber-constrained PNW. Yet, none of these events materialized either disproportionately or collectively to a degree that would drive prices to new highs. Remove the May-August variance, control for a more historical trend and 2018 lumber prices are really in line with historical norms and current demand.

CatchMark Timber Trust, Inc. (NYSE: CTT) announced today that it had completed the sale of approximately 56,000 acres of timberlands in Texas and Louisiana — the Southwest Region — to Forest Investment Associates (FIA) for $79.3 million. As part of the transaction, CatchMark retains approximately 280,000 tons of merchantable inventory (50% sawtimber/50% pulpwood) to be harvested over the next 18 to 24 months. The per-acre sales price was $1,533, including the timber reservations.

Jerry Barag, CatchMark's President and CEO, said: "As a part of a series of coordinated transactions, the Southwest Region sale has enabled CatchMark to recycle capital and diversify our revenue streams, strengthening our capital position, and advancing our future growth track. We have reduced regional exposure in East Texas, after investing in 1.1 million acres of extremely high-quality timberlands through the Triple T joint venture, and redeployed capital into 18,100 acres of prime Pacific Northwest timberlands through the Bandon acquisition — both transactions completed during the summer. Proceeds from the Southwest Region sale are being used to repay debt incurred to fund the Triple T and Bandon investments."

The Southwest Region portfolio, located across counties in East Texas and western Louisiana, was acquired by CatchMark in four separate transactions during 2014 and 2015.

After dropping 5.3 percent in September, US housing starts inched up 1.5 percent to a seasonally adjusted annual rate (SAAR) of 1,228,000 units in October. Single-family starts accounted for 865,000 units, which is 1.8 percent below the revised September figure of 881,000, and starts for the volatile multi-family housing segment jumped 10.3 percent to a rate of 363,000 units in October. Multi-family numbers were off over 15 percent last month, so a bounce back is not unexpected.

Seasonally-adjusted total housing starts by region included:

Seasonally-adjusted single-family housing starts by region included:

The U.S. Supreme Court told a lower court to take another look at the federal designation of privately owned land in Louisiana as critical habitat for the endangered dusky gopher frog.

According to trade data compiled by the US Census Bureau through August, 20181 exports of southern yellow pine (SYP) have increased nearly 1 million cubic meters (m3), or 73 percent, over 2017. If the trend holds, the US South will surpass the Pacific Northwest (PNW) on exports of conifer logs to China in 2018. Export prices2 (to all destinations) for Douglas fir have increased sharply and Hemlock prices have remained flat, but SYP prices have dropped significantly over the last year.

The 20th edition of The UK Forest Market report, produced by Tilhill Forestry and John Clegg & Co., reveals that patience and shrewd forestry investment choices have paid dividends over the last 12 months.

Many UK forest owners who purchased their property 30 or 40 years ago are now reaping exceptional rewards for patiently growing their timber assets. Not only is their investment showing returns of 13.9 per cent per annum, but the price of standing timber has soared 30 per cent in the last year alone - great news for owners whose forests are now ready to harvest.

In discussing the performance of the commercial forestry market in the year to September 2018, the report describes a "brisk and robust" sector. A total of £104.2m of forest properties were traded in 2018. This is a 6 per cent drop from 2017, but, interestingly, the market comprised a smaller number of higher value sales (57 in 2018 compared to 87 in 2017) with an average size of 196 hectares (149ha in 2017) and an average price of £1.83m (£1.28m in 2017). Scotland retained its dominant position in the marketplace with 69 per cent of the sales recorded. *** Peter Whitefield, Business Development Director for Tilhill Forestry, explained: "Motivations for investors vary, but the main reasons are long-term financial returns, the potential for tax planning, long-term capital growth particularly within a pension, or the amenity value."

More conifers were planted in Scotland last year than in any year since 2000. There has been strong demand for woodland creation schemes for 2018/19 with over 12,000ha assessed - well exceeding the Forestry Commission Scotland target of 10,000ha per year. |