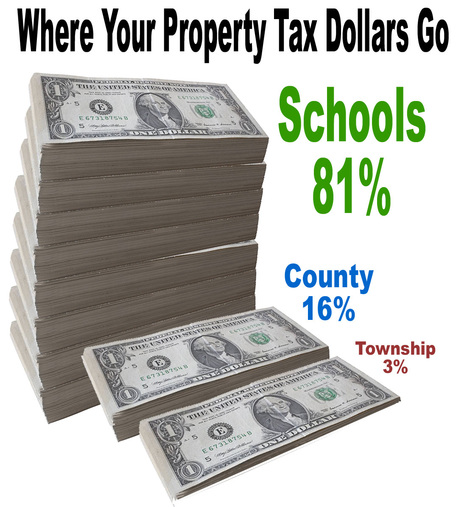

Council Rock School District residents could be facing a higher than normal property tax hike for the 2019-20 school year that starts July 1.

School board members reached consensus at a recent finance committee meeting to have administrators apply to the state for pension and special education exceptions that, if granted, would allow the district to raise taxes higher than the 2.3 percent Act 1 Index normal maximum set for the district in 2019-20.

While emphasizing they won’t necessarily use the exceptions and will work as usual to keep any tax increase as low as possible, board members and administrators said it made sense to give themselves the flexibility to raise more revenue via taxes if it ends up being needed. District Business Administration Director Robert Reinhart recommended applying for the exceptions.

Reinhart is retiring March 14 and won’t be around when the board votes on a final budget and its accompanying tax increase — if any — in June. William Stone, now the top business administrator in the Souderton Area School District, is starting as Council Rock’s new business administration director Jan. 28 and will work with Reinhart for several weeks on the budget.

It doesn’t makes sense to tie the new director’s hands by limiting his ability to raise revenue as he develops the final budget, school board members said at the finance committee meeting. Reinhart added that the district’s fund balance, or savings account, stands at $21 million and he would not recommend drawing from it as a way to balance the 2019-20 budget.

“It’s better to have it if you need it,” board member Jerold Grupp said of applying for the exceptions.

“It’s reasonable to leave that door open,” fellow member Mark Byelich added.

A 2.3-percent tax increase would equate to 2.843 mills, or $109 for the owner of a property assessed at the school district average of $38,400. It would generate about $4 million in revenue, Reinhart said.

|

Scooped by

johnmacknewtown

onto Newtown News of Interest |

Council Rock School District Residents Likely to See Property Tax Hike for the 2019-2020 School Year

No comment yet.

Sign up to comment

Your new post is loading...

Your new post is loading...

Related articles: